- XRP is approaching a critical resistance at $2.21, where the 50-day and 100-day EMAs converge alongside a descending trendline from January.

- Whale wallets holding 10–100 million XRP have increased their share of the token supply by 1.75%, signaling heightened confidence.

Ripple’s XRP price is demonstrating signs of increased bullish sentiments and trades 3% higher at $2.19 as at Thursday. This trend is at the same time witnessed within the larger context in the cryptocurrency market sector, based on the recent Federal Reserve interest rate announcement. Nevertheless, the XRP price continues to be pinned under a critical resistance range. A breakout from here is its chance to defeat a descending trendline that has been preserved for four months.

XRP Price Analysis Amid Fed Rate Pause Decision

The Federal Reserve decided to leave the current interest rate between 4.24% and 4.5% unchanged as of Wednesday. Responding to economic turmoil and worries about U.S. President Donald Trump’s tariff steps, the Chair Jerome Powell indicated the need to see more clearly the economic data before changing rates. While the market barely fazed during Powell’s message, market activity picked up during Thursday’s Asian session, which helped fill investors with confidence in digital assets.

However, the total crypto market capitalization climbed to $3.175 trillion due to a 1.2% increase as the overall sentiment of investors picks up steam. Amongst the top 10 crypto, all recorded gains in the last 24 hours with XRP being among the best.

From the technical indicators, it can be observed that XRP is coming up against critical resistance at $2.21, where the 50-day and 100-day Exponential Moving Averages (EMAs) converge. This level also shores up strongly to a long-term downward trend line from January and is a major barrier to further advances.

There is also increasing market participation. XRP’s Open Interest (OI) has risen by 2.46% reflecting an increased involvement of capital in support of the prevailing trend. Despite the increase in ASK and BIDS., the percentage of increase in Options Open Interest flew higher, going up by 20.45% 24 hours ago to $1 million. The long-to-short ratio at 1.0218 indicates a minor bullish inclination as traders look to push it up further.

Investor Sentiment Changes Massively

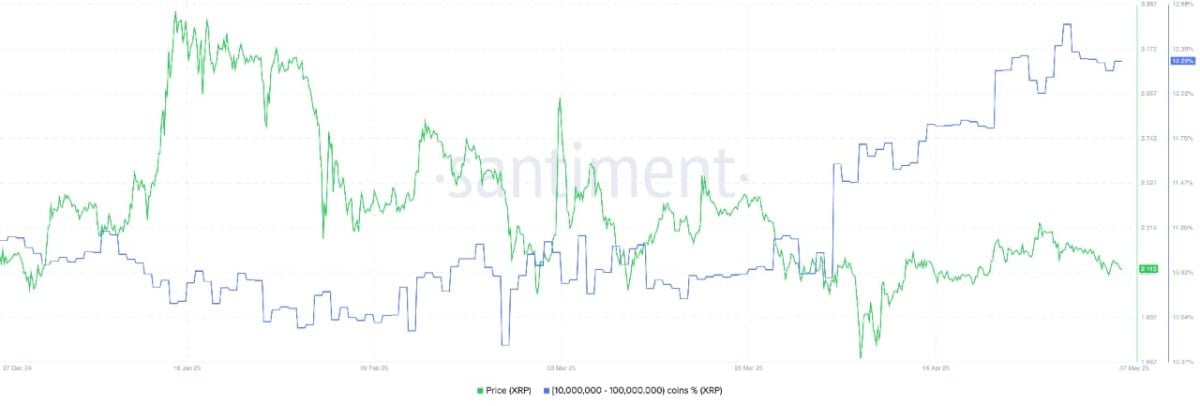

Sentiment among investors seems to be changing, with large holders at the forefront. Based on data from Santiment, wallets with more than 10 million and up to approximately 100 million XRP in their wallets have had their share of the token’s total supply go up from a figure of 10.47% as of February 24 to the current 12.22%, representing an increase of 1.75%. This increase in whale action is viewed by some as an indication of rising confidence in the XRP price trajectory, as mentioned in our report.

Although there is a positive push, some caution should be exercised. The RSI has crossed the 70-mark level, a level that is generally representative of short-term overbought conditions. Meanwhile, the SuperTrend indicator is currently sailing above the price, showing more resistance and headwinds. If the bullish surge fails, areas to look out for the downside are the 200-day EMA at $1.99 to the April 7 low at $1.62.