In DeFi, Hyperliquid stands out due to its innovation. Coingecko data shows that HYPE, its governance token, is the most valuable DEX coin, with a market cap more than twice that of Uniswap (UNI). Currently, Hyperliquid has a market cap of $13.4 billion, and HYPE trading generated over $244 million in volume in the past 24 hours. While volume fluctuates, interest in the HYPE token suggests that Hyperliquid is closely monitored and may become one of the next cryptos to explode if it continues gaining market share.

DISCOVER: Best New Cryptocurrencies to Invest in 2025

Hyperliquid Generates Record Revenue

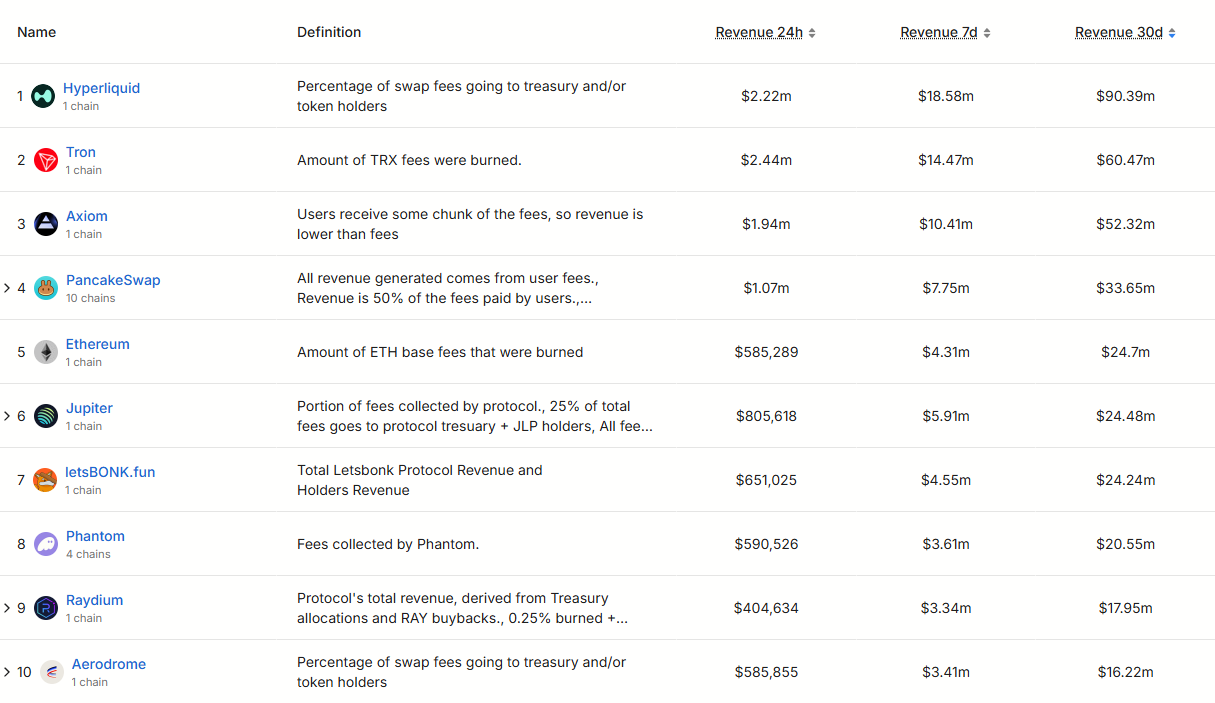

On X, one analyst notes that Hyperliquid, the decentralized perpetual crypto exchange, could be one of crypto’s most compelling stories. In the past month alone, the analyst observes that Hyperliquid generated over $90 million in fee revenue.

(Source: Holosas on X)

At this level, Hyperliquid outperformed Ethereum, Pump.fun, Ethena, Base, Ondo, and even Solana, which collectively generated just $88 million in the past month. For this reason, the analyst is convinced that HYPE is likely grossly undervalued at the current $13.4 billion market cap.

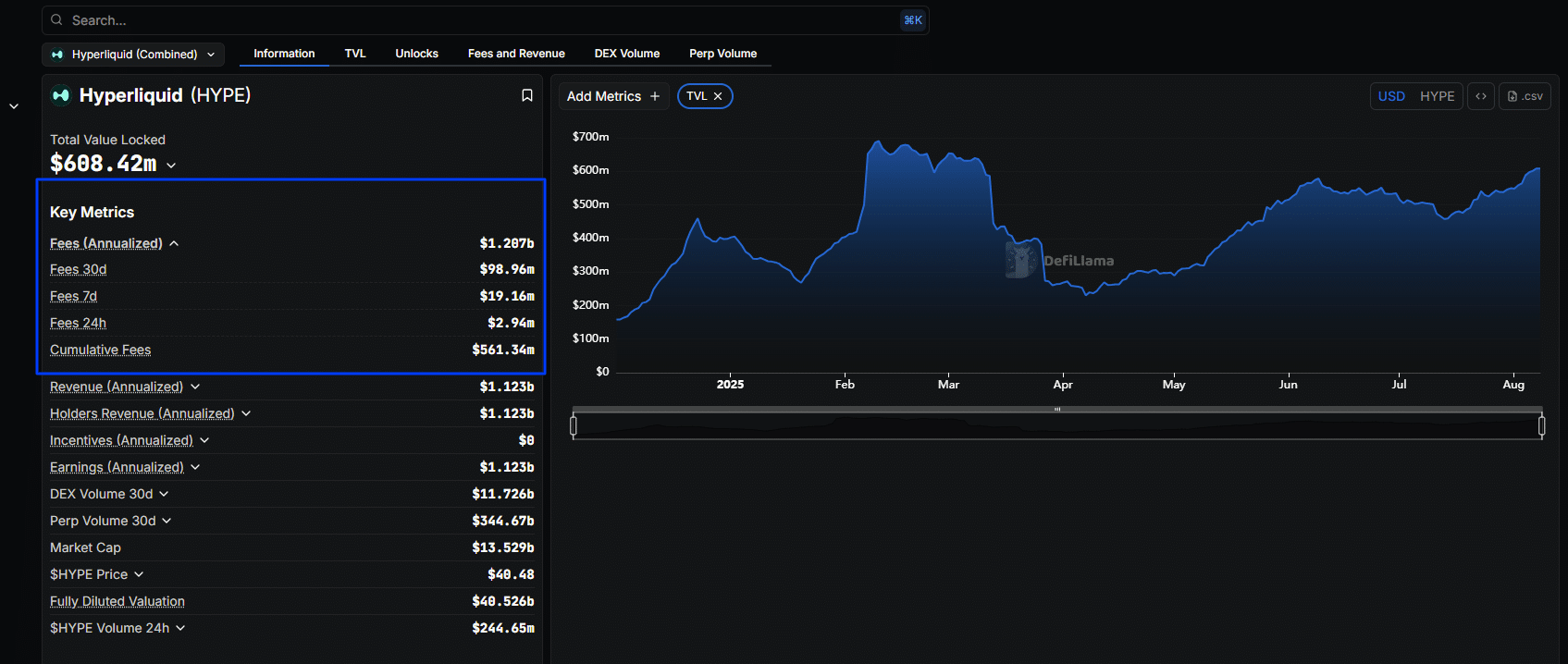

If extrapolated, and the current fee revenue remains, Hyperliquid could easily generate over $1 billion in fees annually, positioning it as a leader among DeFi protocols. According to DeFiLlama, Hyperliquid generated over $19 million in fees in the past week. Cumulatively, the protocol has generated over $561 million in fees.

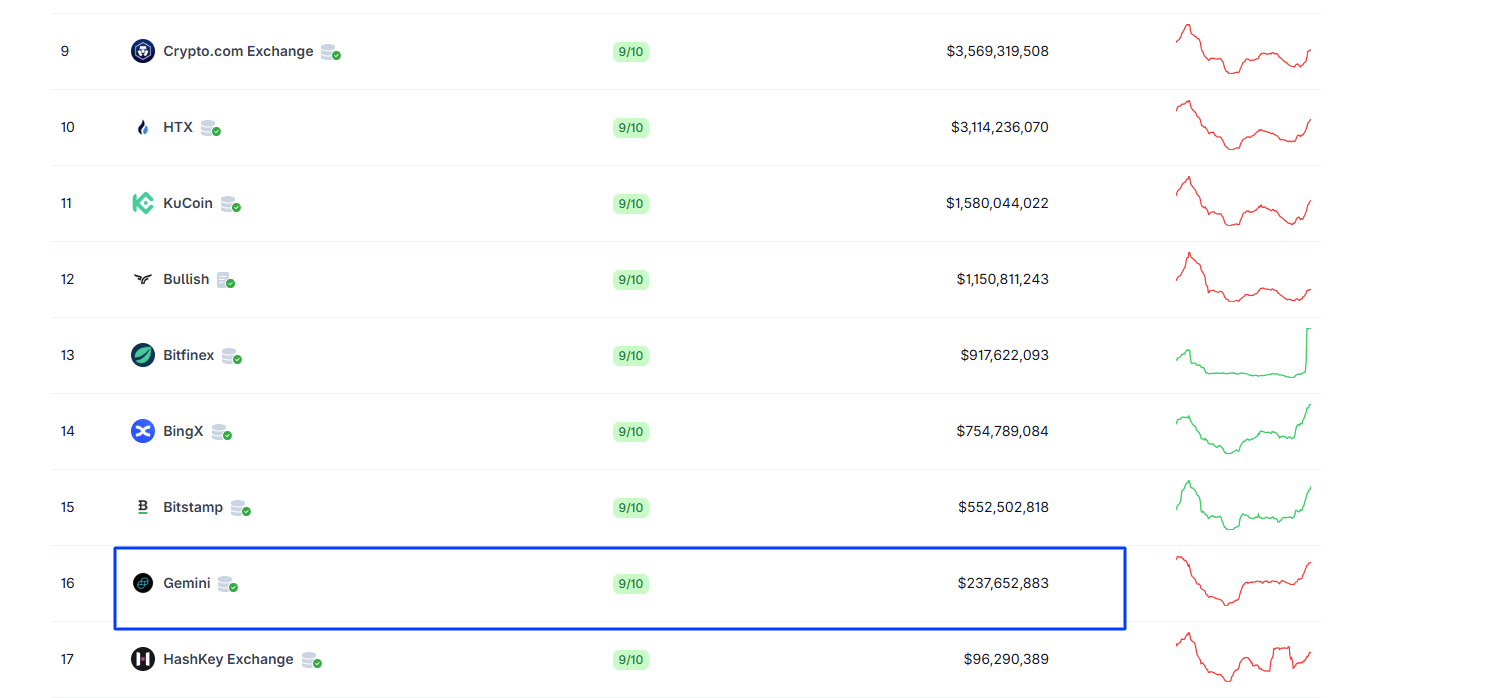

In terms of trading volume, the decentralized perpetual exchange processed over $11.7 billion in the past 30 days, $2.1 billion in the last week, and over $296 million in the past day. At this level, Hyperliquid posted more than Gemini, which recorded nearly $237 million in the past day.

This stellar performance by Hyperliquid is remarkable. It explains why HYPE, in the eyes of optimistic analysts, is just beginning its ascent. At spot rates, is nearly 18% below its all-time high of around $50.

Despite the drop in late July, the uptrend remains intact. HYPE crypto has found support at around $36. If buyers break above $40, there is potential for more growth, building on gains from much of 2025. Since listing on major exchanges in late 2024, HYPE has soared from lows of around $8 to all-time highs of $50, before cooling to approximately $40.

DISCOVER: Next 1000X Crypto: 10+ Crypto Tokens That Can Hit 1000x in 2025

Is HYPE Crypto Undervalued?

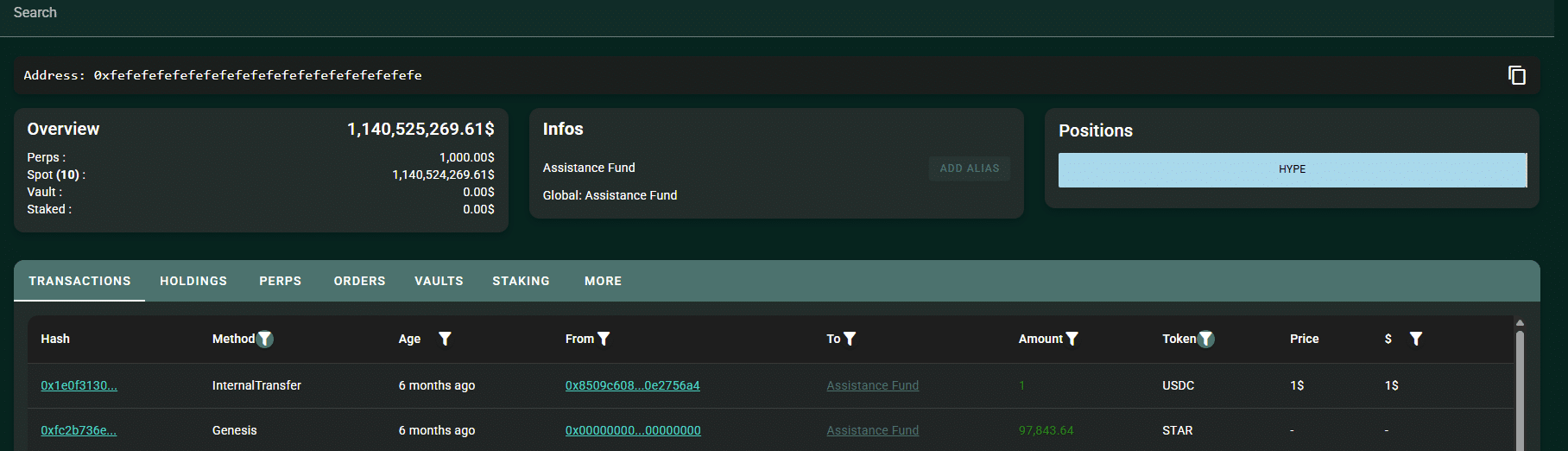

Traders anticipate a supply shock in HYPE. Hyperliquid uses 97% of its revenue to buy back HYPE from the secondary market. At an annualized rate of $1.1 billion, the decentralized perpetual DEX will use over $950 million to acquire more HYPE, reducing the circulating supply and creating sustained upward pressure.

Currently, the Hyperliquid Assistance Fund has amassed over $1.1 billion worth of HYPE through buybacks alone.

At the current buyback rate, one analyst projects that this aggressive mechanism could see the DEX buy back its entire circulating supply within four years.

This aggressive buyback mechanism is unprecedented and far surpasses that of Binance, which aims to eventually reduce its circulating supply from 200 million to 100 million BNB.

DISCOVER: Top Solana Meme Coins to Buy in 2025

Should Hyperliquid further grow its user base and increase its perpetual DEX market share, the exchange may buy back HYPE faster than retailers expect. According to Artemis, Hyperliquid controlled over 75% of all perpetual DEX trading volume as of July 2025. During that time, despite Bitcoin reaching new all-time highs in mid-July, HYPE posted solid gains, adding over 50% compared to Bitcoin’s 13%.

Analysts say the strong performance, record revenue, and buyback program align with the interests of traders and liquidity providers. Together, they create a sustainable and resilient model compared to traditional competitors like Robinhood, making it attractive for investors.

Compared to public crypto companies such as Robinhood or Coinbase, Hyperliquid is lean. The team’s token allocation, per Messari, is less than 25% of the total supply. These tokens are locked until 2027–2028, with only 34% of the total supply of 1 billion in circulation. Messari analysts say this structure gives Hyperliquid an “infinite” fully diluted valuation (FDV), unlike public companies serving similar clients.

DISCOVER: 9+ Best High-Risk, High-Reward Crypto to Buy in 2025

Is Hyperliquid HYPE Crypto Undervalued? DEX Generating Record Revenue

- HYPE crypto could be undervalued

- Hyperliquid generated over $90 million in revenue in the past 90 days

- HYPE crypto prices may soar above $50

- Analysts point to the aggressive buyback plan as a reason to stay bullish

The post Is Hyperliquid HYPE Crypto Undervalued? DEX Generates Record Revenue appeared first on 99Bitcoins.