Key Takeaways

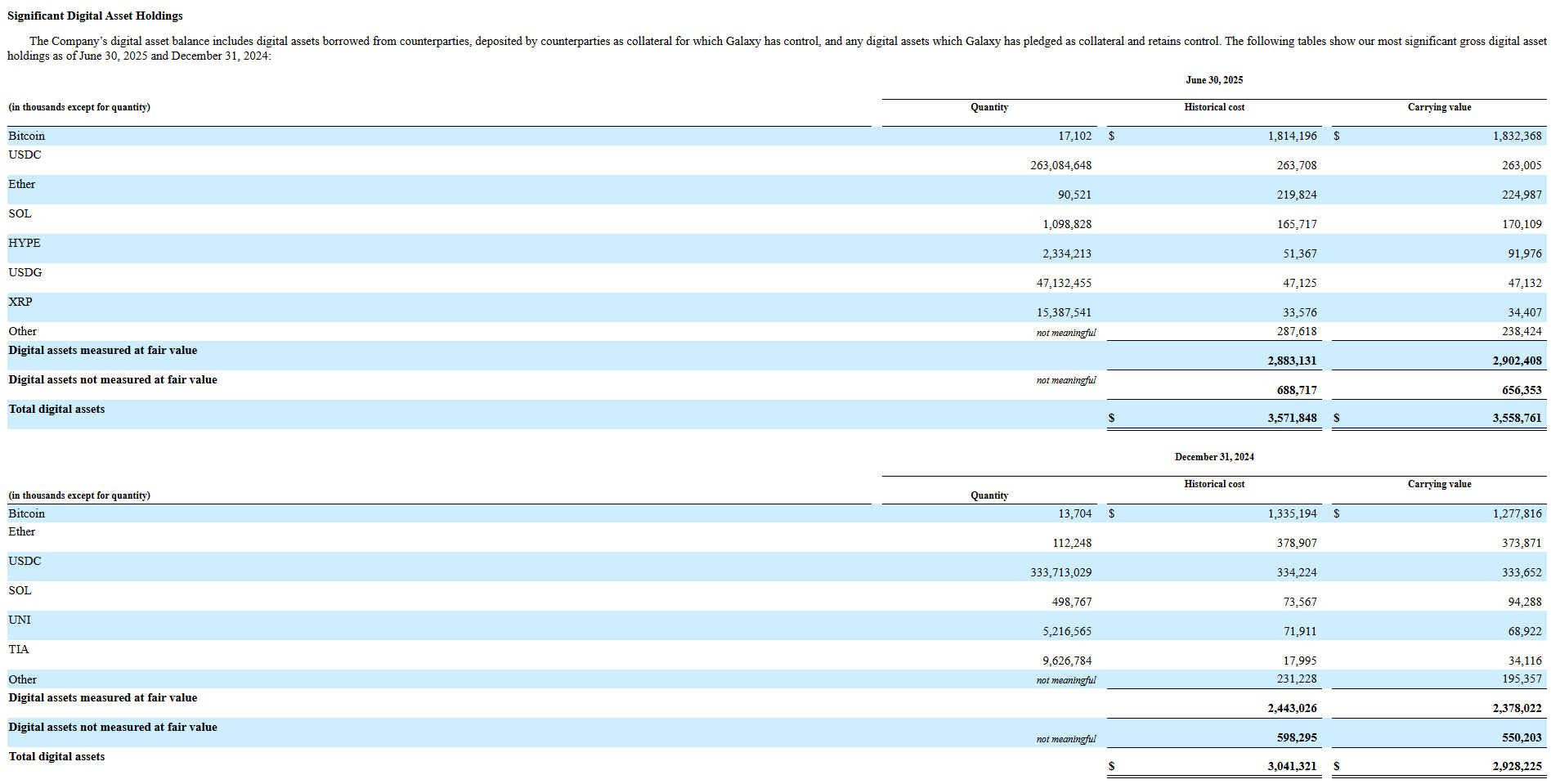

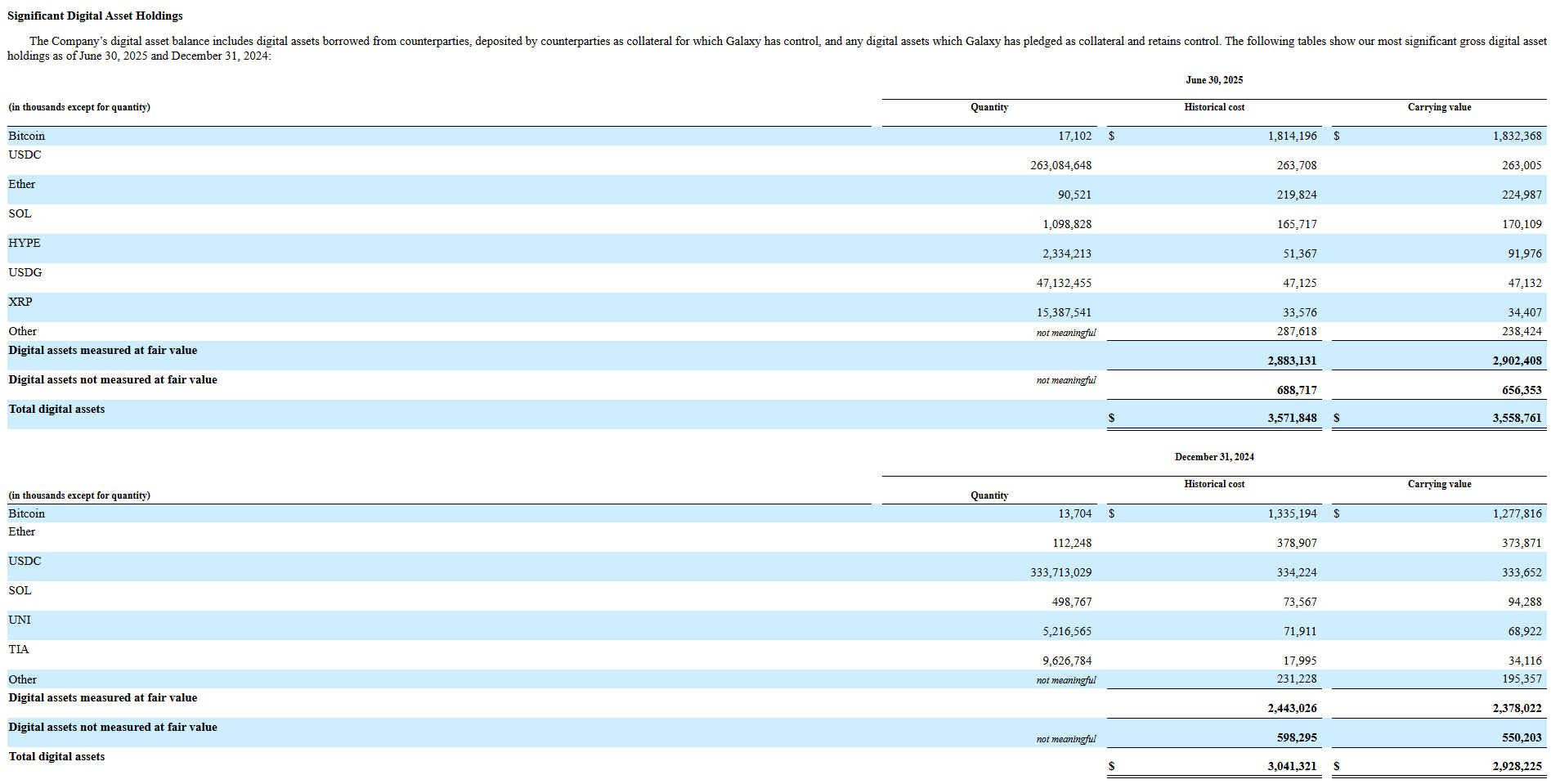

- Galaxy Digital increased its Bitcoin holdings to 17,102 BTC while reducing ETH and XRP exposure in Q2.

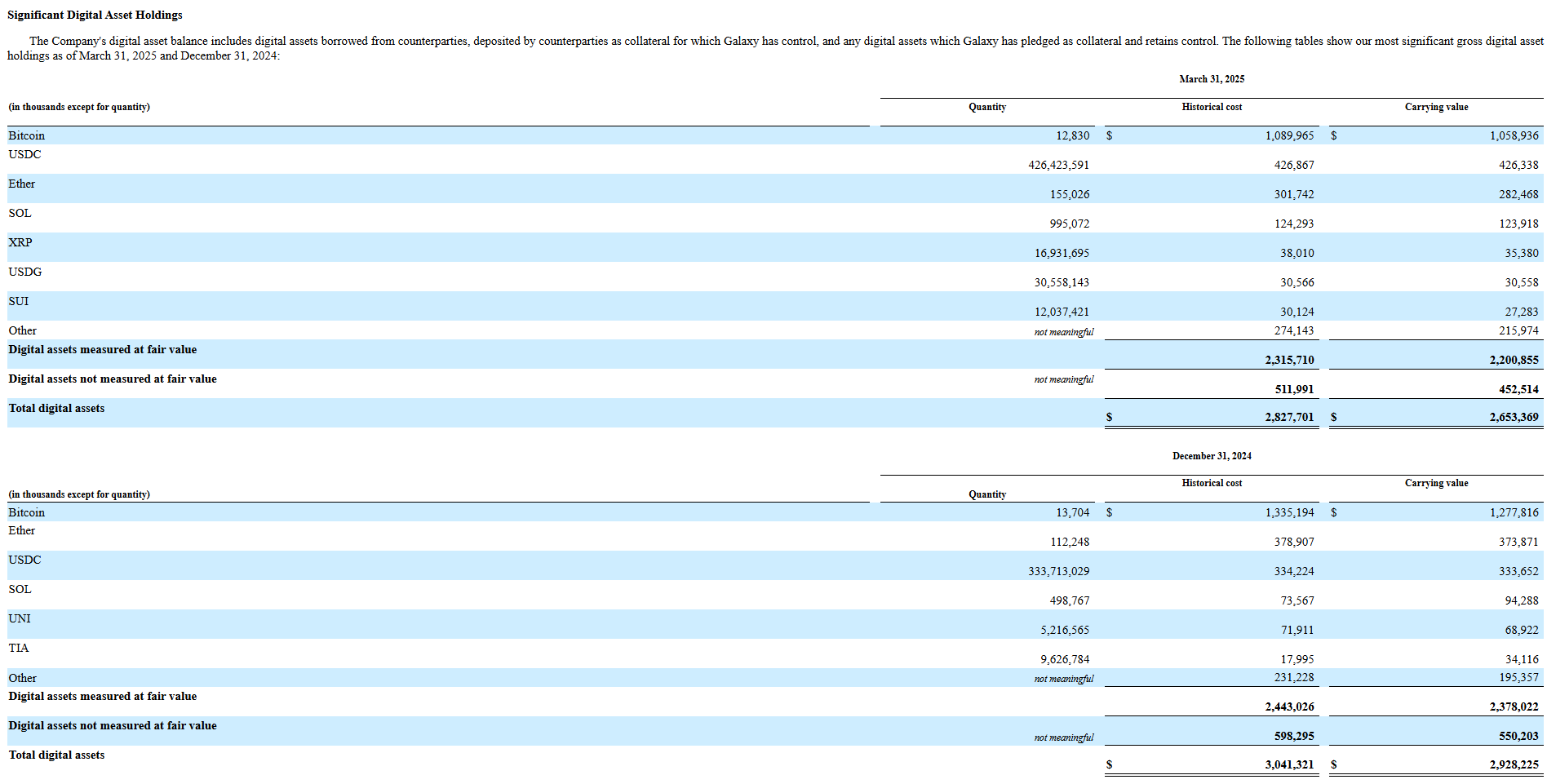

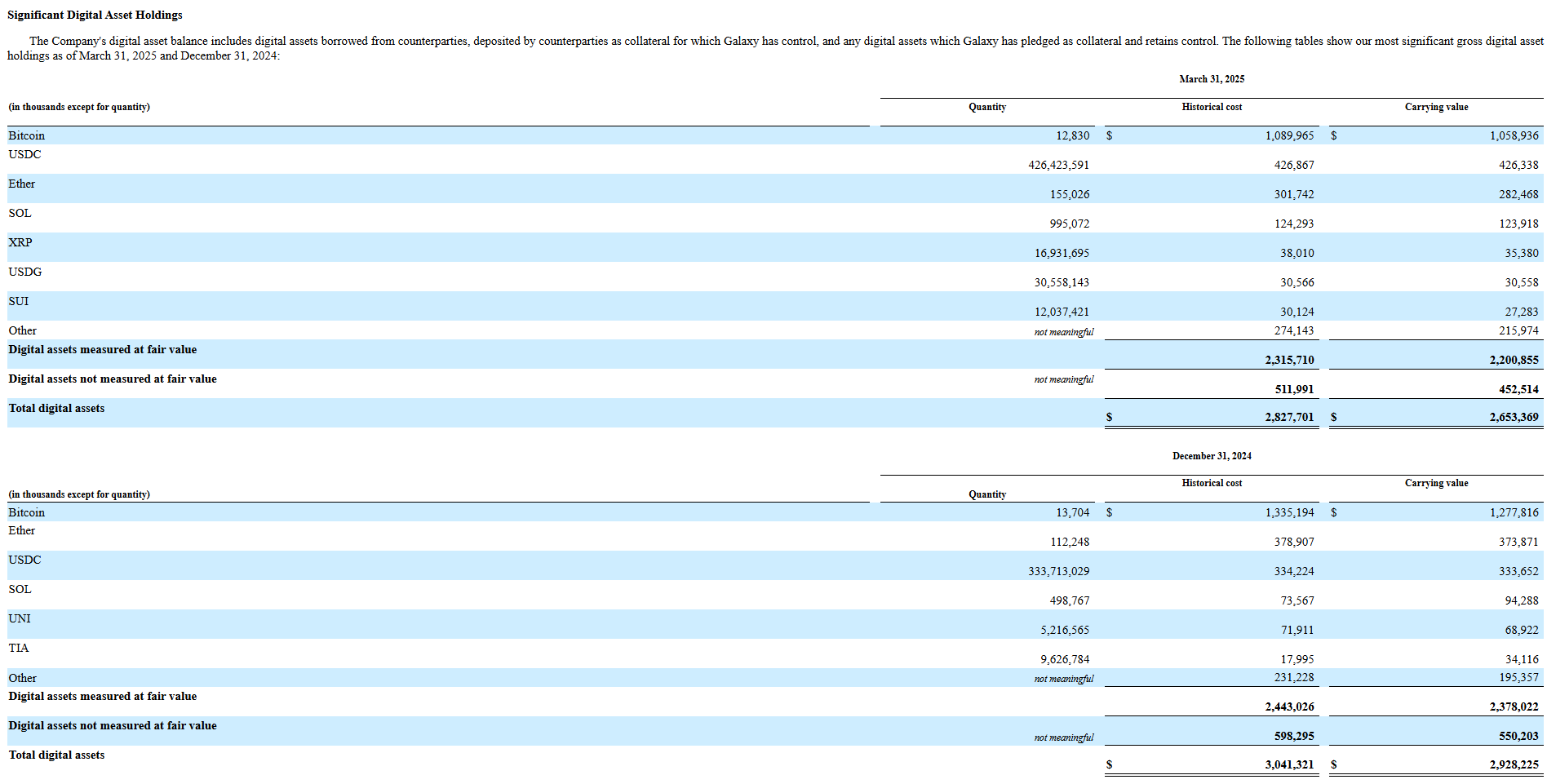

- The firm’s diversified digital asset portfolio includes BTC, ETH, XRP, SOL, and newly added SUI.

Share this article

Galaxy Digital increased its Bitcoin holdings by 4,272 to 17,102 BTC in the second quarter while reporting approximately $31 million in net income and maintaining $2.6 billion in total equity, according to a Tuesday SEC disclosure.

The firm’s net digital asset holdings rose to $1.2 billion, a 40% increase from Q1, driven by increased Bitcoin exposure.

The company’s digital asset portfolio showed mixed adjustments across major crypto assets in Q2. While Bitcoin holdings grew, Ethereum holdings decreased to 90,521 from 155,026 in Q1, per the filing.

XRP exposure declined to 15.4 million from 16.9 million, while Solana exposure increased to 1.1 million from 995,072. The firm also added exposure to SUI. These include borrowed assets from counterparties, assets deposited as collateral under Galaxy’s control, as well as Galaxy’s assets pledged as collateral.

Galaxy expands staking and trading despite spot volume drop

Galaxy’s Digital Assets segment delivered $71 million in adjusted gross profit, a 10% quarter-over-quarter increase, while adjusted EBITDA held steady at $13 million.

The gains were fueled by Galaxy’s Global Markets business, which saw a 28% jump in gross profit to $55 million, even as overall spot trading volumes declined 22%.

On the infrastructure side, Galaxy’s Asset Management and Infrastructure Solutions segment saw mixed results.

While staking revenues declined amid softer on-chain activity, total assets on the platform rose to $8.9 billion, up 27% quarter-over-quarter, with assets under stake climbing to $3.1 billion, a 34% gain. Galaxy also expanded its staking footprint through a new integration with Fireblocks.

The company’s Treasury & Corporate division reported $228 million in adjusted gross profit, driven by mark-to-market gains on crypto and investment holdings. This segment was the largest contributor to Galaxy’s consolidated adjusted EBITDA of $211 million and net income of $30.7 million, reversing a $295 million loss in the previous quarter.

“July marked the strongest monthly financial performance for our Digital Assets operating business in the firm’s history, with record results in Global Markets and steady progress in Asset Management & Infrastructure Solutions,” Galaxy stated.

Nasdaq debut and recent BTC sale

One of Galaxy’s key milestones in Q2 was its Nasdaq debut in May. CEO Mike Novogratz revealed plans to work with the SEC on tokenizing Galaxy’s stock in order to integrate it into decentralized finance applications.

Galaxy Digital recently completed a historic transaction, selling more than 80,000 Bitcoin valued at over $9 billion. Despite the scale of the sale, Bitcoin prices only saw a brief dip before quickly rebounding.

Share this article